The US is in major trouble, this being the gigantic amount of debt it has issued. The debt burden is getting bigger by the second and shows no sign of stopping.

For those that aren’t sure what this means, it means less public spending in the future, more inflation, and a large scale economic crisis ahead.

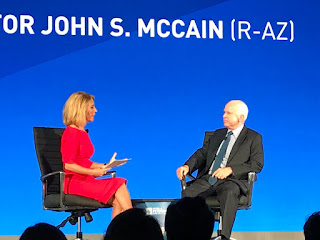

Major trouble attracts major attention, so on May 23rd, 2017, the well known Peter G. Peterson Foundation hosted the 2017 Fiscal Summit, with prominent speakers like Senator John McCain, Senator Mark Warner, House Democratic Leader Nancy Pelosi (and many others) all convening to discuss the national debt, the current political landscape, and implications of the debt for the nation's future.

The key message from the conference is this: nothing can be done and nothing will be done unless the Republicans and the Democrats work together. Right now, there’s little hope for that.

Bipartisanship is an unknown land at this point, and very, very far away, since each party sees the other as the major threat to the nation's well being. In Congress, there is a lot of quarreling going in and nothing coming out. Whatever the Democrats propose, Republicans oppose. The problem is further complicated by tension between the new White House and the Congress. When the White House tries to propose legislation to the Congress, it is met by fierce opposition and disapproval. Healthcare reform is a good example. Tax reform is another.

Even with Republicans controlling the White House, the Senate, and the House of Representatives, problems aren’t solved and in fact the situation is made worse. And remember, this is not the right time to do nothing. The national debt is at a dangerously high level and it keeps on rising. Interest charges are growing at an alarming rate and eating away a major chunk of tax revenue. The result: public spending’s are getting squeezed by interest payments.

Things need to be done right now, even at the cost of some pain-there are no painless solutions at this point: either you cut spending, increase taxes, or print more money. Each has its adverse effects on parts or all of society. However, it would be less painful to fix the problem right now than to fix the problem later by "kicking the can down the road."

The longer the wait, the harder the fix.

Another complication is the Trump/Russia investigation, made ever more difficult by the firing of FBI director James Comey. During one of the sessions, Senator Mark Warner gave a firm stance on the issue, he will relentlessly pursue the investigation until things are made clear. (Just moments ago, news of the Senator issuing a new request for documents from Michael Flynn came out.)

A tough, tough issue.

Edited by William Michael Cunningham

For those that aren’t sure what this means, it means less public spending in the future, more inflation, and a large scale economic crisis ahead.

Major trouble attracts major attention, so on May 23rd, 2017, the well known Peter G. Peterson Foundation hosted the 2017 Fiscal Summit, with prominent speakers like Senator John McCain, Senator Mark Warner, House Democratic Leader Nancy Pelosi (and many others) all convening to discuss the national debt, the current political landscape, and implications of the debt for the nation's future.

The key message from the conference is this: nothing can be done and nothing will be done unless the Republicans and the Democrats work together. Right now, there’s little hope for that.

Bipartisanship is an unknown land at this point, and very, very far away, since each party sees the other as the major threat to the nation's well being. In Congress, there is a lot of quarreling going in and nothing coming out. Whatever the Democrats propose, Republicans oppose. The problem is further complicated by tension between the new White House and the Congress. When the White House tries to propose legislation to the Congress, it is met by fierce opposition and disapproval. Healthcare reform is a good example. Tax reform is another.

Even with Republicans controlling the White House, the Senate, and the House of Representatives, problems aren’t solved and in fact the situation is made worse. And remember, this is not the right time to do nothing. The national debt is at a dangerously high level and it keeps on rising. Interest charges are growing at an alarming rate and eating away a major chunk of tax revenue. The result: public spending’s are getting squeezed by interest payments.

Things need to be done right now, even at the cost of some pain-there are no painless solutions at this point: either you cut spending, increase taxes, or print more money. Each has its adverse effects on parts or all of society. However, it would be less painful to fix the problem right now than to fix the problem later by "kicking the can down the road."

The longer the wait, the harder the fix.

Another complication is the Trump/Russia investigation, made ever more difficult by the firing of FBI director James Comey. During one of the sessions, Senator Mark Warner gave a firm stance on the issue, he will relentlessly pursue the investigation until things are made clear. (Just moments ago, news of the Senator issuing a new request for documents from Michael Flynn came out.)

A tough, tough issue.

Edited by William Michael Cunningham